Instead of a rundown on the latest multifamily news and trends, this week we are going to take a look at one key takeaway for active apartment investors…

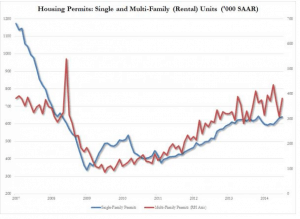

The latest housing reports suggest that multifamily construction is booming while single-family construction lags behind. On its face, this analysis is correct.

It’s also not very helpful for experienced apartment investors.

Allow me to explain….

There are few actionable national trends in commercial real estate (aside from financing). Individual market conditions are still the primary drivers of investing success and they do not interrelate. A good quarter in Houston does not correlate to a good quarter in Detroit.

As an active multifamily investor, it’s not enough to know the national homeownership rate is at historic lows. Likewise, being aware of the national multifamily vacancy rate (also near record lows) only offers you a benchmark for judging the relative health of an individual market.

As an active multifamily investor, it’s not enough to know the national homeownership rate is at historic lows. Likewise, being aware of the national multifamily vacancy rate (also near record lows) only offers you a benchmark for judging the relative health of an individual market.

To be truly successful in multifamily investing (in good times and bad times) you must know your markets inside and out, and not let yourself take false comfort in national statistics.

This is why your team is so important. An excellent property manager will be able to show you how those national trends are manifesting themselves in your local market. They can tell you what projected vacancy and rent growth should look like in any specific neighborhood. Armed with that detailed and useful information you can make educated investment decisions, regardless of the national trends.

Still, these nationwide views of construction permits and vacancy are proving that multifamily’s current performance is broad-based. This is not a surprise. The demographic trends driving the multifamily sector are happening in most markets in the U.S. But the best markets show additional, positive metrics that point to stable and steady growth for the next decade or more.

And that is where you will find the most successful apartment investors.

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.