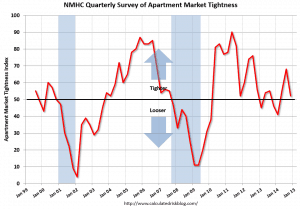

The multifamily sector continues to strengthen. Despite a booming construction environment, vacancies remain low and rents are increasing. While we frequently point out the importance of Echo Boomers in this sector, Baby Boomers are beginning to make their presence felt. Just as we predicted.

The multifamily sector continues to strengthen. Despite a booming construction environment, vacancies remain low and rents are increasing. While we frequently point out the importance of Echo Boomers in this sector, Baby Boomers are beginning to make their presence felt. Just as we predicted.

Foreign capital is flooding into multifamily assets. We have seen this phenomenon first-hand. It makes the purchasing environment more competitive. While most foreign capital is remaining in the largest apartment markets, it will likely filter into smaller markets if the trend continues.

“It Depends.” It’s an answer we give to Multifamily Partners early in their education process. We are not being evasive. In commercial real estate, context drives almost every answer. Take this look at renter hotspots. Is it a good thing if your market has a renter pool that is above the national average? It can be. Markets with a lot of renters are often very expensive. You will get operational stability. But you will pay for it when entering the market.

You might consider commercial real estate to be a rather dry and somewhat boring endeavor. I beg to differ. I once saw two experienced real estate investors engage in a lively debate on how to actually calculate returns. It got very intense, very quickly. I don’t agree with every part of this article as I think the author is overlooking a key return component. Still, he makes some good points.

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.