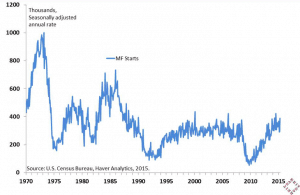

There are few national trends in commercial real estate. Still, having command of national statistics gives you perspective when looking at an individual market. Nationally, multifamily construction is growing, but not anywhere near historic highs. Specific markets are either well above the national numbers or below. Where do you think you should be?

There are few national trends in commercial real estate. Still, having command of national statistics gives you perspective when looking at an individual market. Nationally, multifamily construction is growing, but not anywhere near historic highs. Specific markets are either well above the national numbers or below. Where do you think you should be?

Keeping in mind the national numbers we just discussed, it’s interesting to see how much more of an impact Baby Boomers had a few decades ago on multifamily construction than their Echo Boom counterparts are having right now. The reason is simple: Renters need jobs. And the Echo Boomers are facing a very tough employment market. We will continue to monitor the unique financial pressures this generation is facing. It has a direct impact on the multifamily sector in every market.

Many people think the best way to get started in apartment investing is through a REIT. They would be wrong. When you invest in a REIT, you are actually investing in a company that invests in real estate. That one degree of separation may seem inconsequential, but it isn’t. You lose important tax benefits when you chose a REIT over direct ownership. You also are tied to the stock market and can have poor returns even when the properties are performing well.

We are happy to announce the recent acquisition of Oaks of Westchase, a 182 unit apartment complex in Houston, TX. This deal was discovered by two of our Multifamily Partners who then walked with us step by step as we negotiated and closed on the property. The experience they acquired was invaluable, and they are on the hunt right now for another great deal.

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.